Welcome to our in-depth exploration of worldwide gambling statistics, where we delve into the latest trends and offer valuable insights into the dynamic landscape of gambling across the globe. From emerging markets to evolving player behaviors, join us as we uncover the captivating stories hidden within the numbers.

The Global Gambling Sector in The Past Few Years

Covering the industry’s financial prowess and player-specific behaviors, we’ve dissected crucial statistics and presented them in easily digestible segments for your leisurely perusal.

Whether it’s a poker enthusiast assessing their potential winnings, a roulette player evaluating their chances of success, or a company unveiling their recent earnings report, numerical information saturates every aspect of gambling. Grasp these figures to enhance your gaming experience to the fullest!

Global Gambling Statistics: The Grand Picture

Before delving into the intricacies, let’s initially grasp the overarching concept using a broad perspective. The realm of gambling is diverse and occasionally intricate, yet beneath the surface, its numerical aspects present an encouraging outlook.

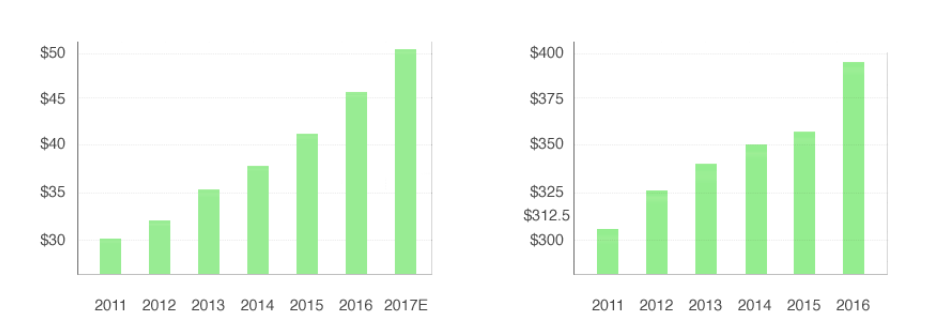

Commencing from the summit, the foremost significant figure for gamblers today is the aggregate value of the entire industry. Segregated into two primary categories—physical establishments and online platforms—the gambling domain has witnessed remarkable expansion over the past half-decade.

The left graph illustrates statistics concerning online gambling in billions, while the right graph portrays comprehensive gambling statistics also in billions.

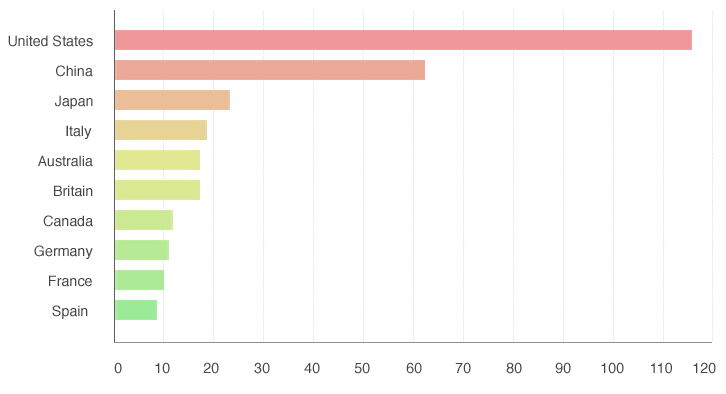

Analyzing gambling revenues on a country-by-country basis, we observe China and the US leading the rankings. (Statistics from 2015)

| Country | Amount ($B) |

| 🇨🇳 China | $24.3 |

| 🇺🇸 US | $23.5 |

| 🇯🇵 Japan | $12.4 |

| 🇩🇪 Germany | $4 |

| 🇰🇷 S. Korea | $4 |

| 🇬🇧 UK | $3.8 |

| 🇫🇷 France | $2.7 |

| 🇪🇸 Spain | $1.8 |

| 🇨🇦 Canada | $1.79 |

| 🇮🇹 Italy | $1.74 |

Online Gambling Figures

Global statistics on gambling highlight that approximately 26% of the global population engages in gambling activities. This equates to roughly 1.6 billion individuals worldwide participating in gambling, with around 4.2 billion people gambling at least once per year. In terms of online gambling and demographic statistics, a study conducted in the UK indicates that 17% of the population partakes in online gambling, contributing to a remarkable £5.3 billion in revenue solely for the online market.

The scenario is distinct in the United States. In 2016, a mere 3% of the 4.2 billion individuals who expressed regular gambling habits acknowledged participating in online gambling. However, it’s reasonable to assume that this figure increased in subsequent years, given that the revenue for the US online gambling sector reached $306.5 billion in 2018.

Who’s Struggling the Most?

“The gambling industry consistently showcases its position as one of the most dynamic entertainment economies worldwide.”

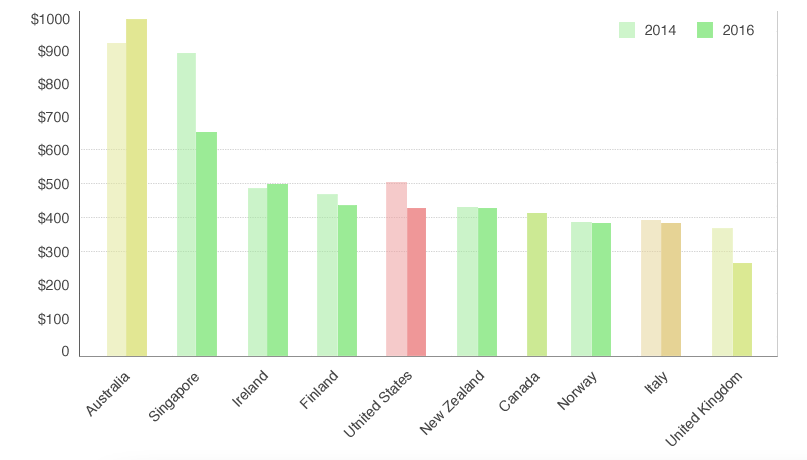

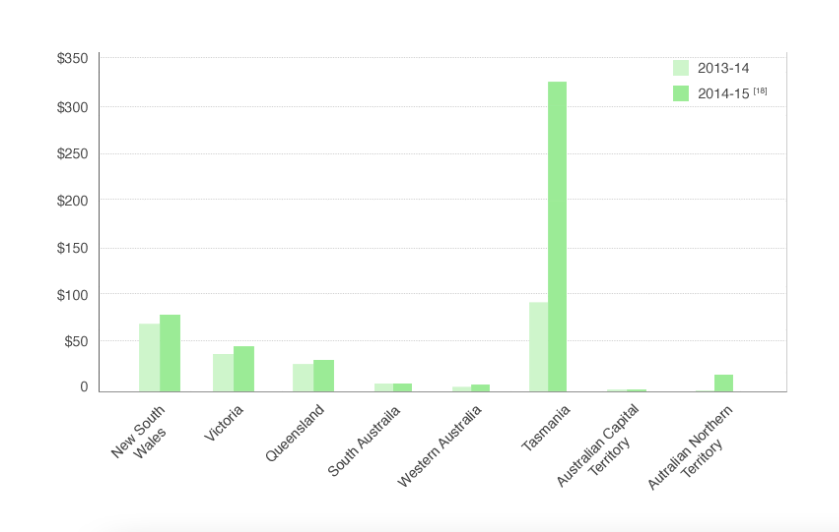

In terms of individual gambling engagement, Australians currently hold the lead. In 2014, Australians wagered over $916 per person, closely followed by Singaporeans at $891.16. Given Singapore’s recent legalization of casino gambling, per capita spending is expected.

Despite being the birthplace of Las Vegas, Americans rank a distant third, with a per capita spending of $505.44. Ireland, known for its lenient approach to gambling, follows closely with $490.39. The UK, boasting both legal land-based and online gambling, and recognized for its premier licensing regulations, trails behind at $377.83.

An intriguing inclusion in the top 10 is Malta. This small Mediterranean island possesses a modest population yet one of the highest per capita losses worldwide. Malta stands as a prominent gaming jurisdiction, housing numerous major online gambling platforms and affiliates.

Average Adult Gambling Losses in 2014: A Global Perspective (USD)

Country-wise Gambling Losses in 2016: A Look at the Numbers (USD, Billions)

The Worldwide Gambling Sector: Where the House Prevails

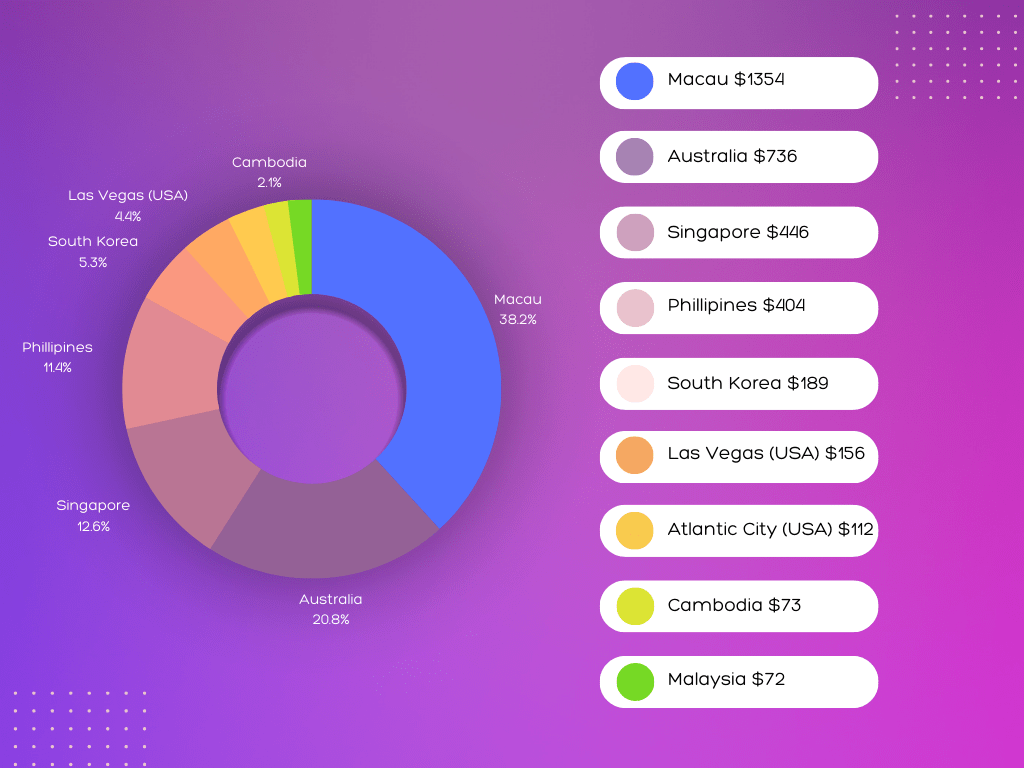

As is customary, statistics hinge on one’s viewpoint. Thus, perusing the catalog of global gambling losses simultaneously reveals the triumphs of gambling operators. Bearing this in mind, here’s an analysis of the ten leading destinations for gambling revenue, as determined by visitor engagement.

It’s intriguing that Macau claims the first position in per capita revenue. However, Chinese citizens don’t appear on our list of the highest gambling losses. Despite recent challenges to Macau’s tourism industry, visitors continue to secure the former Portuguese colony’s prominent position.

Australia emerges as a noteworthy contender both in terms of losses and revenue. The nation boasts a higher count of “pokies” (slot machines) compared to many other countries, a remarkable feat considering its population of only 22 million people.

Prominent Gambling Hubs

In the realm of gambling, equality prevails. Despite differing locations, chosen games, and wagered amounts, we all contend with uncertain odds when engaging in live or online betting. Yet, akin to a stack of casino chips, certain nations have ascended higher than others in recent years.

So, which country stands out as the most fervent gambler? Through a combination of effective regulation, innovative approaches, and skillful promotion, the US, UK, Australia, Canada, and Macau have all carved their positions as gambling luminaries since the early 2000s.

1. Macau

With its focus primarily on casino gaming, Macau takes the lead in the gambling scene.

China’s relationship with gambling is a mixture of attraction and apprehension. The country runs state-owned lotteries catering to its billion-plus populace, yet the majority of online and live gambling remains prohibited. The challenge facing China, or more precisely its government, pertains to managing Macau.

This former Portuguese enclave has evolved into one of the world’s largest gambling destinations, operating as a Special Administrative Region of China. While it maintains a degree of autonomy from Beijing, it has faced significant pressure from the mainland to lessen its dependence on gambling revenue.

Governance: The oversight of gambling in Macau falls under the Macau Gaming Inspection and Coordination Bureau (DICJ). Additionally, the DICJ supports the Chief Executive of Macau in devising economic strategies for the city.

Macau boasts a total of 38 casinos, featuring prominent projects from international giants like Sands, Wynn, and Melco Crown.

Revenue from casino games in Macau during 2016 (2015):

- January 2016: 18,674 million MOP (MOP 23,478)

- February 2016: 19,521 million MOP (MOP 19,542)

- March 2016: 17,981 million MOP (MOP 21,487)

- April 2016: 17,341 million MOP (MOP 19,167)

- May 2016: 18,389 million MOP (MOP 20,346)

Overall, Macau has witnessed a decline in gross gaming revenue (GGR) for several years. A crackdown on capital flows from China to Macau has posed challenges for numerous casinos. A shift towards offering ‘mass market’ entertainment within casinos might reshape Macau’s prospects. Alternatively, high-stakes players and VIPs could explore alternative gambling havens like Australia, Singapore, and the Philippines.

2. United States of America

Games: Poker, Casinos, Sports Betting, Horseracing, Lottery, Daily Fantasy Sports (DFS), Bingo

Even with Macau’s prominence, the United States maintains its leading role in the global gambling arena, with Nevada at its core, fostering a thriving casino industry.

While online gambling has been prohibited in numerous states, many have embraced the establishment of casinos, whether on tribal lands or under private management. State-sponsored lotteries are prevalent across most regions of the United States.

In a pivotal move in 2013, Nevada, New Jersey, and Delaware emerged as trailblazers by introducing regulations for online gaming. As a result, Nevada now operates online poker platforms, while Delaware and New Jersey have successfully legalized online casinos and poker platforms. Although online sports betting is accessible in certain states, it remains restricted in many others.

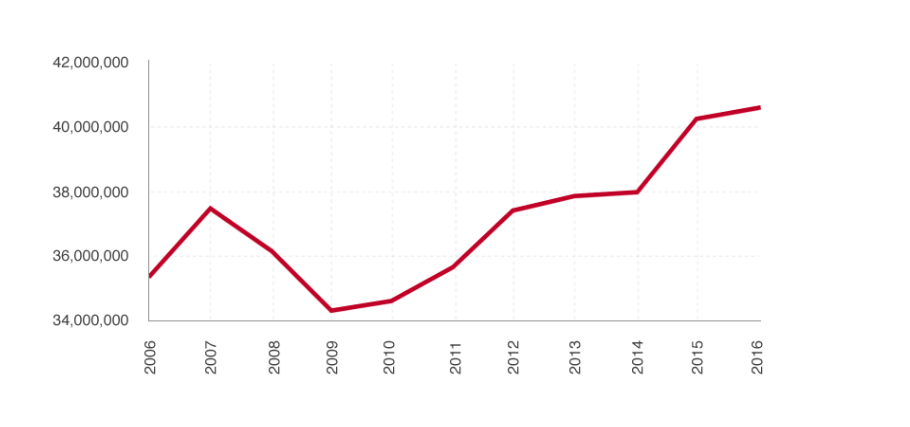

As per the statistics from the University of Nevada, Las Vegas (UNLV), commercial casino gaming revenues in the United States have shown a consistent upward trajectory over recent years:

Commercial Casino Gaming Profits in the USA:

Nevada understandably takes the lead with a substantial $11,113,830 share of the US casino gambling market in 2015. On the contrary, New Jersey has experienced a tumultuous journey. As the host of Atlantic City, it has witnessed the closure of casinos, leading to a decline in casino revenue from $5.2 million in 2006 to $2.5 million in 2015.

New Jersey took a pivotal step in 2013 by legalizing online gambling following the relaxation of internet gambling laws. The Division of Gaming Enforcement (DGE) supervises legal internet gaming operations within the Garden State.

How much revenue does gambling generate annually? In 2017, the aggregate gross revenue amounted to $158.54 billion. This figure increased to $161.24 billion in 2018. In 2017, the largest slice came from Pari-Mutuel betting. However, by the subsequent year, Bookmaking had taken the lead, amassing a staggering $430 million in revenue.

The governance framework: Lotteries, casinos, and sportsbooks are subject to state-level regulations. While online sports betting remains prohibited in numerous US states, the surge in popularity of Daily Fantasy Sports (DFS) has sparked challenges to this law. Nevada and New Jersey have legalized land-based casinos and implemented some form of legal online gambling. California and Florida host thriving live poker industries under legal auspices. Nonetheless, these states have resisted calls for legalizing online poker. Pennsylvania has recently adopted a more liberal stance, encompassing both its land-based and online gambling markets.

3. United Kingdom

Games: Sports Betting, Poker, Lottery, Bingo, Horseracing, Casino, Mobile Gaming, Social Gaming

As a pioneer in the gambling sector and a standard-bearer in terms of regulatory measures, all thanks to the UK Gambling Commission, the United Kingdom has showcased remarkable statistics in recent times. From the abundance of betting establishments to the sheer magnitude of the market, the UK undoubtedly stands out as a prominent gambling hub.

Within the UK, there are brick-and-mortar casinos and poker rooms, bingo facilities, as well as a regulated national lottery. Additionally, British individuals are permitted to engage in real-money gambling on mobile and online gaming platforms.

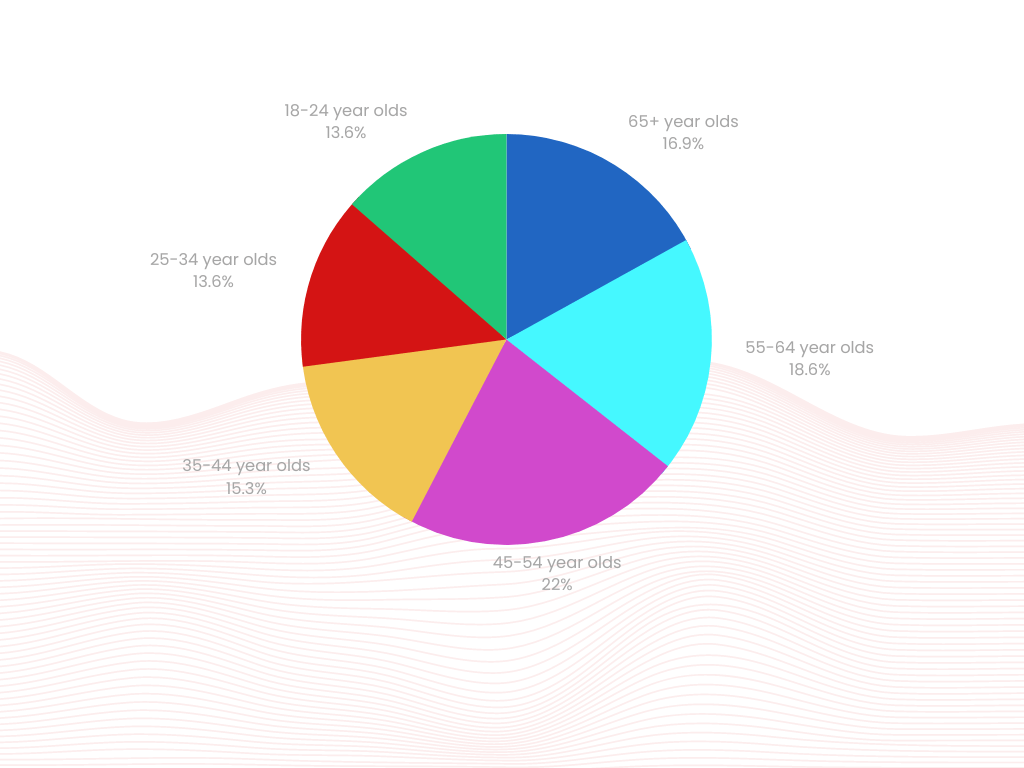

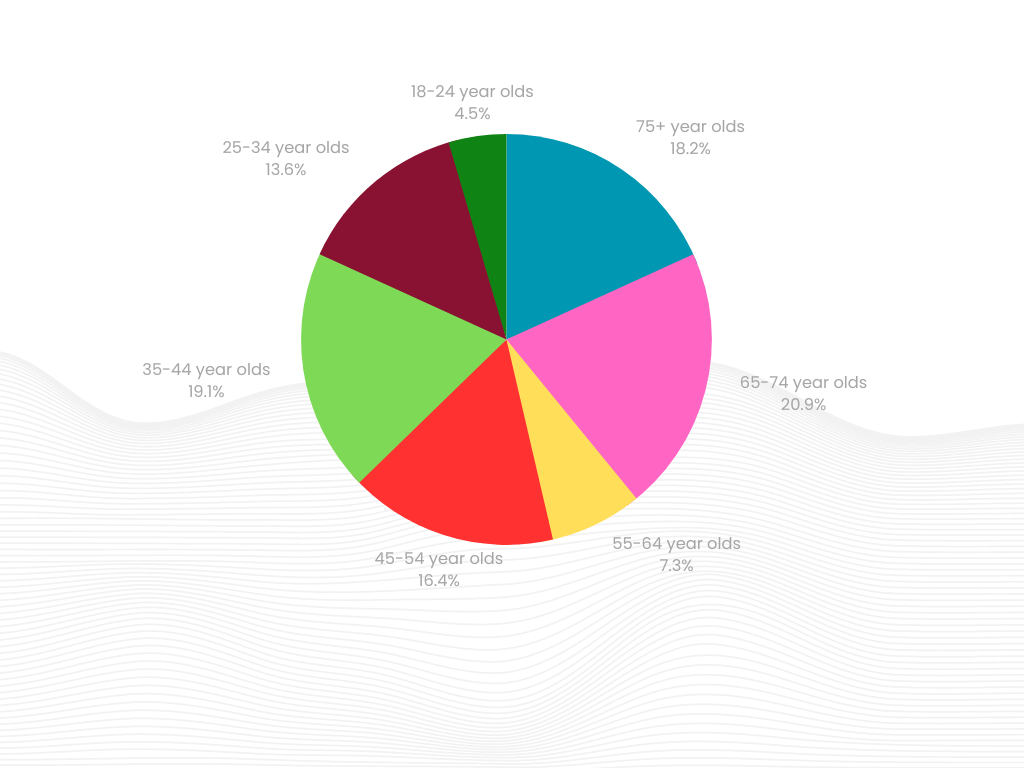

Gambling participation in the UK by age

“Within the United Kingdom, online and mobile betting contributed to a Gross Gaming Yield (GGY) of £710.19 million during the period of 2011-12.”

Regulation Overview: Oversight of gambling activities in the United Kingdom is carried out by the UK Gambling Commission, an authoritative body established in 2005 following the decision of the then-Labour government to liberalize gambling regulations.

The UKGC bears the responsibility of supervising casinos and granting online licenses to gambling websites. Since the enactment of the Gambling (Licensing and Advertising) Act in 2014, all offshore betting platforms seeking to cater to UK customers are obligated to pay the “Point of Consumption” tax and obtain a license from the UK Gambling Commission.

Online Gambling Landscape in the UK: Remote betting has experienced significant expansion within the UK. The combination of online and mobile betting contributed to a Gross Gaming Yield (GGY) of £710.19 million during the 2011-12 period. This figure surged under recent legislation to reach £3.6 billion during 2014-15. Individuals over the age of 18 in the UK are authorized to engage in gambling activities at land-based casinos, online platforms, and via mobile devices.

Controversy surrounds Fixed Odds Betting Terminals (FOBTs) in brick-and-mortar bookmakers. These terminals offer casino-style slots and roulette to customers walking in from the high street. Despite efforts to curtail betting limits and the rate of players’ losses, FOBTs persistently contribute to a substantial domestic betting industry.

4. Australia

Continuously pioneering the integration of the industry and the broader society, Australia has upheld its position of gaming supremacy for over a decade. A fusion of contributions from pokies supporting local sports, the influx of Asian tourists engaging in live casinos, and a thriving online sector have led to Australia showcasing notable gambling statistics in recent times.

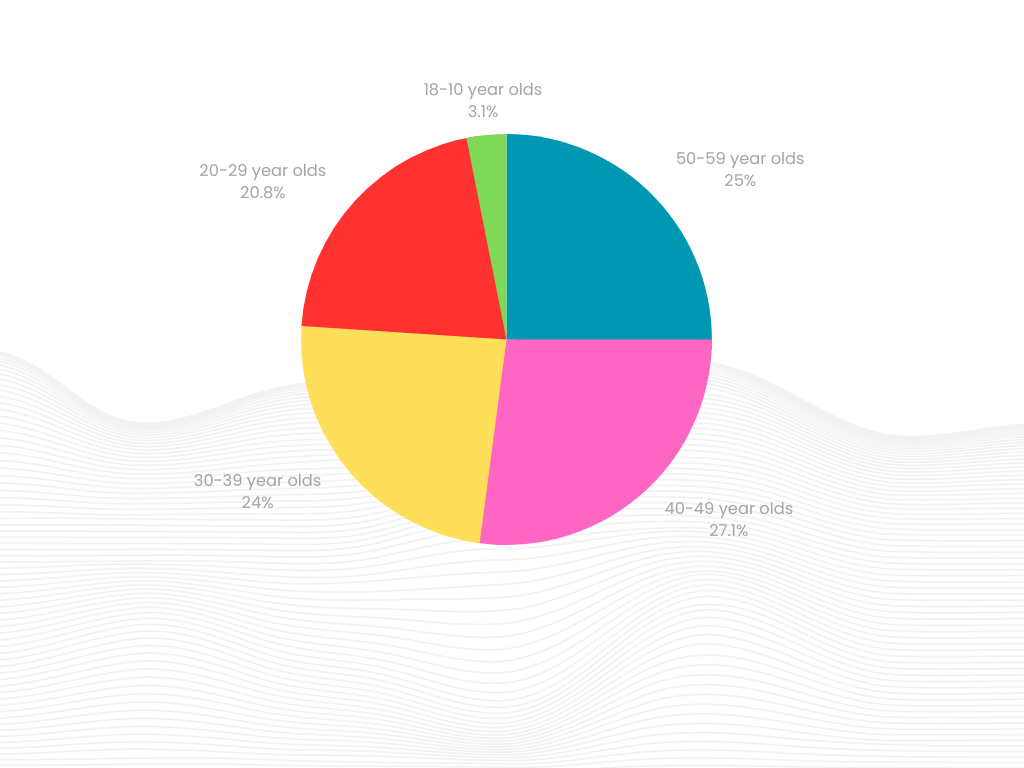

Breakdown of Australian Gamblers by Age (Statistics from 2011)

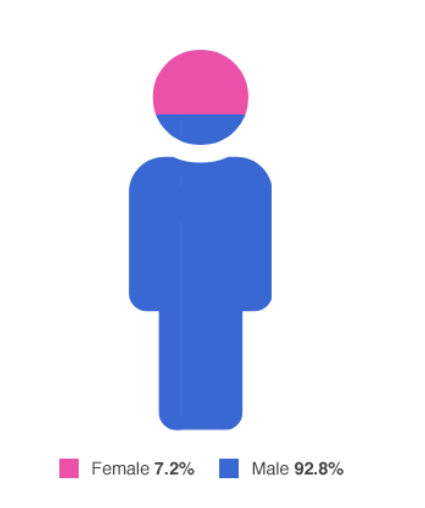

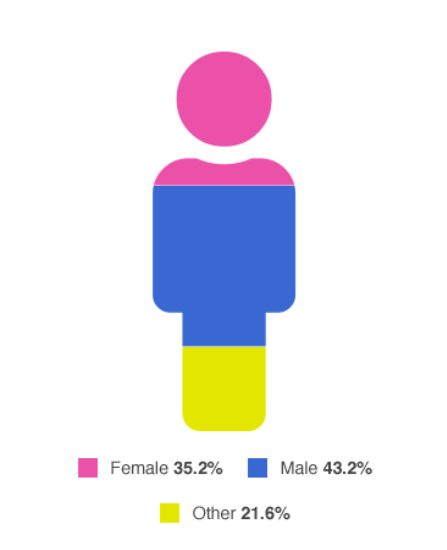

Distribution of Aussie gamblers by gender (from 2011)

Total gaming turnover (2013-2014)

Distribution of Aussie gamblers by age (from 2015)

Distribution of Aussie gamblers by gender (from 2015)

Contentious “pokies” (poker machines) hold sway in the domestic gaming landscape in Australia, often referred to as “Down Under.” This local term denotes what are commonly known as slots or fruit machines. Alongside the presence of land-based casinos in Melbourne and Sydney, pokies are prevalent in pubs and clubs across the majority of states. In Western Australia, the availability of pokies is currently limited to casinos, though this circumstance might evolve.

Recent statistics reveal that approximately 2.9 million Australian adults aged 18 and above engaged in playing pokie machines, constituting around 16 percent of the adult population. Among them, 42 percent participated on a weekly basis.

Meanwhile, the surge of interest in sports betting is notable. State-operated TAB outlets extend opportunities for Australians to wager on a diverse spectrum of sports.

Regulation Approach: Each individual state retains the authority to permit local operators to host poker machines. In Victoria, the responsibility for live sports betting and lotteries is shared by Tabcorp and Tatts in a duopoly arrangement.

Recently, the Interactive Gambling Act (IGA) of 2001 underwent revisions to prohibit so-called ‘in-play’ betting on sports within Australia. While certain online sports betting sites operate in Australia, primarily licensed in the Northern Territory, online casinos remain banned. Numerous offshore online casinos situated abroad continue to accept Australian registrations.

AU$156.9 billion ($116 billion) Cumulative worth of the Australian gambling sector (2013-2014)

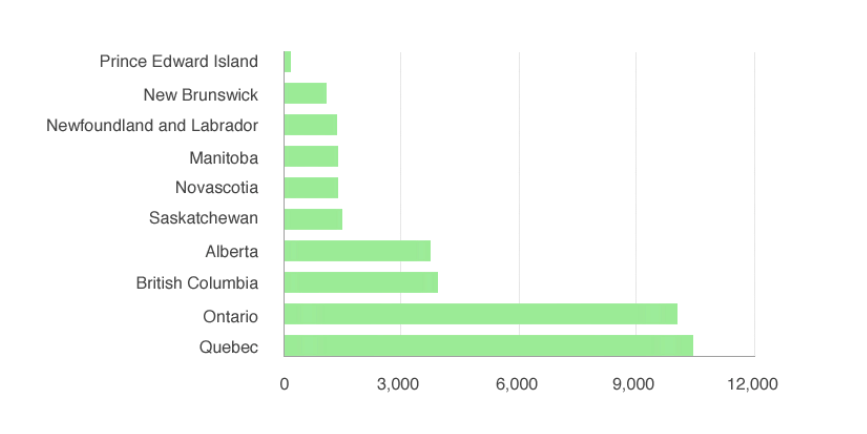

Serving as a central hub for numerous online gambling operators and software providers, Canada has harnessed the benefits of its open-handed stance towards gambling, distinct from its North American counterpart. Thanks to this harmonious blend of innovation and regulation, Canada has emerged as a frontrunner among global gambling domains.

In addition to major land-based casinos situated in British Columbia and Ontario, Canada proudly hosts one of the world’s foremost online gambling regulatory jurisdictions. Nestled near Montreal, Kahnawake is home to the Kahnawake Gaming Commission (KGC), an entity responsible for granting licenses to online casinos and poker platforms.

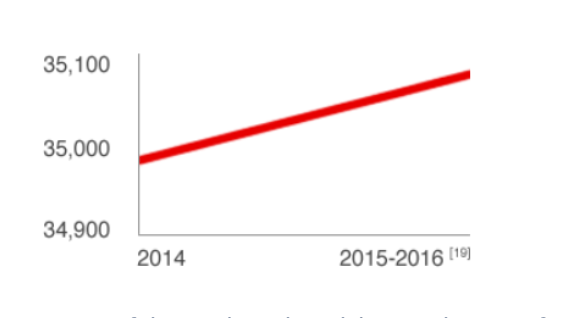

- Count of gaming establishments within the Canadian gambling industry (2014) = 34,955

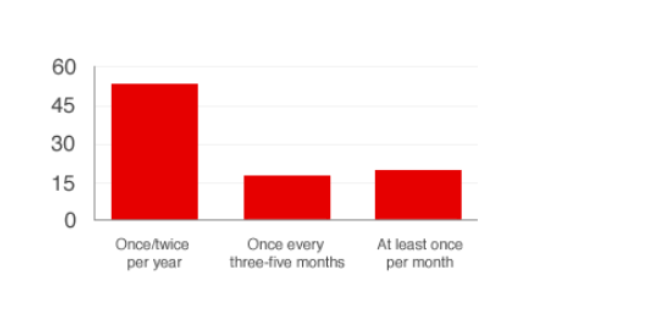

- Number of visits millennials made to casinos as of January 2014:

- Once or twice a year = 53%

- Every three to five months = 17%

- At least once a month = 19%

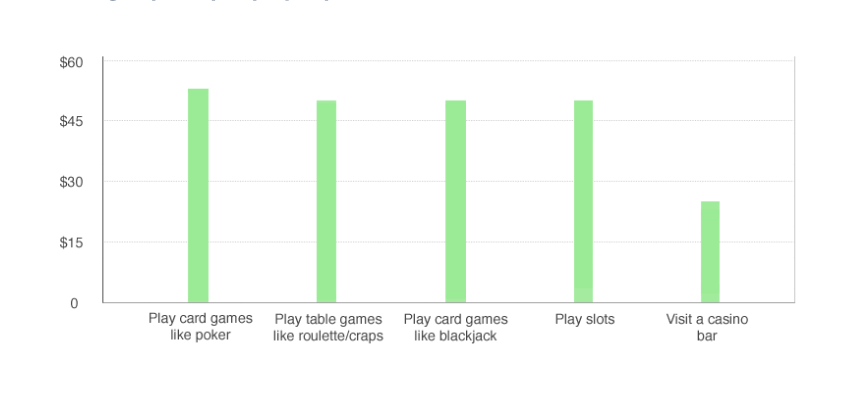

- Average expenditure per player during a casino visit:

- Engaging in card games like Poker = C$53 ($40)

- Participating in table games like Roulette/Craps = C$50 ($38)

- Playing card games like Blackjack = C$50 ($38)

- Using slot machines = C$50 ($38)

- Visiting a casino bar = C$25 ($19)

Number of gaming areas in the Canadian gambling industry:

Number of times millennials visited casinos as of Jan 2014:

Average spend per player per casino visit (CAD):

Number of venues and designated gaming areas in the Canadian gambling industry (2015-2016):

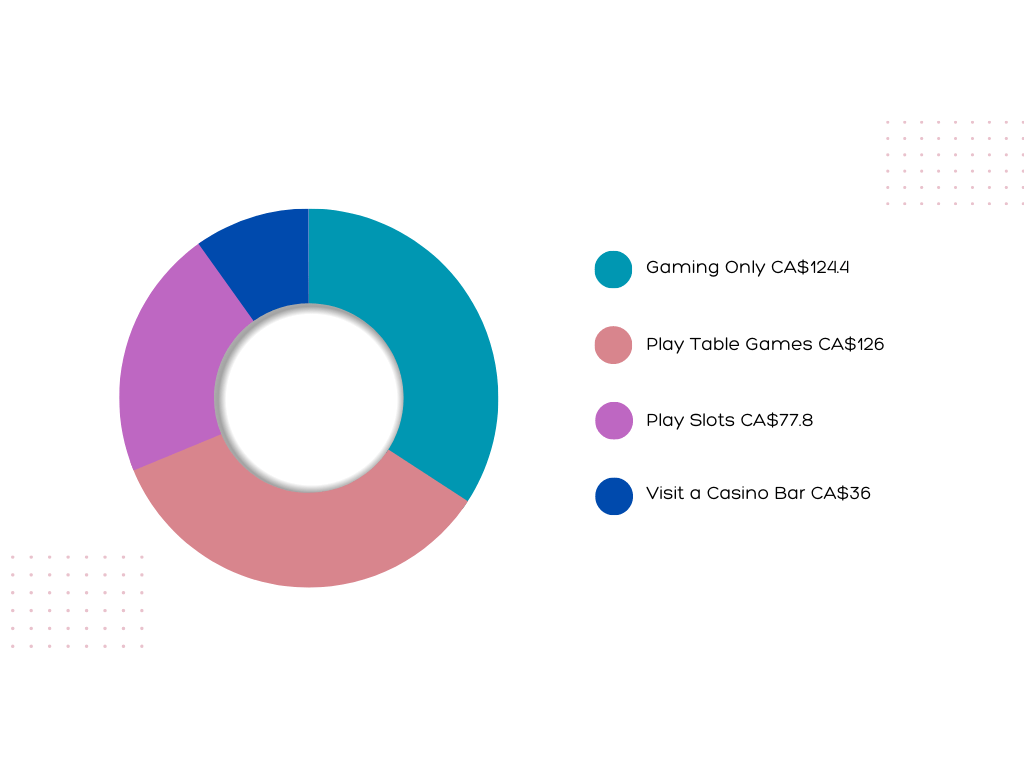

Activity Participation – Casino Visitors – Mean Spend (2015-2016):

Roughly 76% of adult Canadians are believed to partake in various forms of gambling. This percentage, corresponding to nearly 30 million individuals, stood at 29,650,033 as of 2017. The Canadian betting sector is appraised to yield an annual revenue exceeding $15.5 billion.

CA$15.1 billion ($11.6 billion) Aggregate worth of the Canadian gambling sector in 2010

Evaluating the Rest of the Field

While the UK, Australia, and Canada may command the most substantial stacks in the industry, this doesn’t imply that the remainder of the world is left without any chips.

Before we conclude our comprehensive examination of gambling statistics, let’s swiftly explore some remarkable figures from emerging global players.

- Despite being a relatively nascent market in the realm of gambling, a notable 44% of Singaporeans aged 18 and above engaged in some form of gambling in 2014.

- Germans notch an average annual win of $115 each, earning them the ninth spot in terms of per capita victories.

- Russia’s losses in annual gambling for 2013 amassed to $2.7 billion.

- Having risen to prominence as the premier live casino hub worldwide, Macau succeeded in attracting 31.5 million visitors in 2014.

- In Spain in 2014, a total of 3.9 million players registered with online gambling platforms.

- Benefiting from its sizable population of 127 million, Japan’s gambling industry enjoys robust support. One report disclosed that Japanese gamblers spent $31 billion in 2013.

The Ascension of Social Gambling/Casino:

In 2016, the global social casino market reached an estimated valuation of $3.81 billion. The social casino sector has experienced an impressive Compound Annual Growth Rate (CAGR) of +23% since 2013. By 2017, this sector was projected to hit a lucrative stride, generating $4.4 billion. Analysts anticipate the industry to further ascend to $4.63 billion by CY20, implying a 4-year CAGR of 5%.

In 2015, an estimated 173 million gamers existed worldwide.

Global Market Share of Social Casino Publishers:

During 2016, Playtika continued to dominate the social casino publishing landscape with a 25.4% market share, followed by SciGames Interactive at 8.4%, and Zynga at 8.1%. Collectively, these top three companies accounted for 42% of the total social casino game market, while the top 15 contributed to roughly 83%.

Top Social Casino Publishers in 2016

| Rank | Company | Key titles | Revenue (millions) | Market share |

| 1 | Playtika | Slotomania, House of Fun, Bingo Blitz, WSOP, CZR Casino | $946.8 | 24.9% |

| 2 | Zynga | Zynga Poker, Hit it Rich!, Wizard of Oz Slots, Black Diamond | $324.1 | 8.5% |

| 3 | Scientific Games | Jackpot Party Casino, Gold Fish Casino, Quick Hits, Hot Shots | $298.8 | 7.8% |

| 4 | IGT | DoubleDown Casino | $279.2 | 7.3% |

| 5 | Aristoctat | Heart of Vegas, FaFaFa – Real Casino Slots, Hollywood Spins | $224.6 | 5.9% |

| 5 | GSN Games | Bingo Bash, GSN Casino, Fresh Deck Poker, Mirrorbal | $184.9 | 4.9% |

In 2016, North America maintained its status as the most substantial social casino market among all regions, boasting a total of 1.7 billion U.S. dollars, closely trailed by Asia and Europe.

Within the U.S., U.K., and Australia, approximately 37% of players engaging on both PCs and mobile devices partake in social casino games, encompassing options like slots, poker, bingo, blackjack, roulette, and baccarat. Among these, slots claim the lion’s share of popularity as the most favored social casino game, embraced by 53% of social casino participants.

The U.K. boasts the largest segment of players, commanding a substantial 58%.

Most popular gambling games

- Casino Games/Slots:

The realm of casino gaming typically falls under a broader “betting” category encompassing bingo and lottery activities. Nonetheless, casino gambling has seen a rise, climbing from 35.1% in 2013 to 32% in 2007.

The latest statistics among U.S. casino attendees reveal that nearly half (48%) engage in slots, while 16% opt for blackjack, and 6% for poker. Roulette constitutes just 5% of popular gameplay. (Source: Statista).

The surge in mobile and online slots has yielded some substantial winners, with progressive jackpots leading to life-altering victories, where players have secured prizes ranging from $5-7 million over recent years.

- Sports Betting:

The global sports betting industry stands as a billion-dollar domain. However, the unregulated sports betting landscape in Asia suggests that the industry’s overall worth might surpass this figure by many more billions. Illicit betting syndicates in China and other regions have orchestrated fortunes won and lost in connection with sporting events.

In the regulated sports betting sector, the global market accounted for $58 billion. This figure is anticipated to rise to over $77 billion by 2016. (Source: European Gaming and Betting Association).

- Poker:

Online poker’s prominence has experienced ebbs and flows since its zenith in the early 2000s. The closure of U.S.-facing platforms has led to a reduction in online traffic. Even within regulated markets, online poker figures are confronting challenges. This occurs in tandem with a general escalation in the number of players participating in live cardrooms.

Grand rewards continue to be associated with live tournaments, with the World Series of Poker main event victor securing a payout of around $7-10 million. The most prominent online tournaments attract sufficient participants to award first prizes in the million-dollar range.

- Lottery:

Lotteries are legally operational in many countries, even in regions where traditional betting and casino-style gambling remain outlawed. The European Gaming and Betting Association (EGBA) projects a surge in lotteries’ share of the overall online gaming spectrum, growing from 2.3% in 2013 to 4% in 2016.

In the UK, the National Lottery serves as a dual purpose, raising funds for charitable causes and affording players the opportunity to win substantial prizes. Lottery rewards escalated by 22% between 2012 and 2015, with payouts amounting to £3.38 billion in 2012 and £4.13 billion in 2015.

- Bingo:

Estimations suggest that around 100 million individuals worldwide engage in online bingo, with a significant majority (70-80%) being women, primarily aged between 30 and 50. In 2015, the annual gross-gaming yield from UK customers in the online bingo sector reached £128.64 million, contributing 3% to the overall online gambling market share.

The iGaming Equation Unveiled

As the statistics demonstrate, the gambling industry is currently experiencing a period of robust growth. From brick-and-mortar casinos in Canada to the thriving online realm in Spain, the count of players participating in wagers is unmistakably on the rise.

Despite the global recession and regulatory challenges having caused certain segments of the gambling industry to progress at a slower pace than initially projected over the past decade, the overall financial landscape remains positive. In reality, as we journey towards the future, the emergence of technological advancements like mobile casinos, live dealer games, and potentially virtual reality, are actively contributing to propelling annual revenues to unprecedented heights.

Hence, whether one is an operator, a player, or simply an individual fascinated by numerical dynamics, the gambling industry consistently demonstrates its position as one of the most dynamic and lively entertainment economies worldwide.

Anticipating the Future Path for Global Gambling

Arguably, there exists no industry on the contemporary global stage that can parallel the remarkable expansion and vigor seen within online gambling. Throughout the world, a wave of innovation is sweeping through, as an increased number of brands compete vigorously for player engagement, leading to a surge in wagering activities.

Given the present landscape of worldwide gambling, all eyes are now turned toward the future. However, as many can attest, forecasting the trajectory of the gambling realm is undoubtedly a challenging endeavor. In a bid to provide greater clarity, we’ve meticulously dissected the statistics, providing you with an advanced glimpse of what lies ahead.

Projected to Surpass $635 Billion

Evident from the outset is the remarkable valuation projected for the casino industry in 2017, poised to ascend beyond $635 billion in the imminent years. To delve deeper into this statistic, a closer examination of the two pivotal contributors to casino gaming’s expansion is warranted – namely, the United States and the United Kingdom. Within the United States, anticipated cash revenues are poised to reach $21.14 billion, while the UK is expected to register online gambling revenue of $4 billion. These individual figures collectively contribute to an anticipated 5.7% augmentation of the global gambling market by the time 2022 arrives.

The substantial growth within the realm of casino play primarily resides in the online domain. Traditional land-based casino engagement continues to experience a decline, barring a few exceptional pockets, mirroring the trend of the preceding years. As novel online markets emerge, it’s plausible to assume that the online casino industry will persist in overshadowing land-based establishments.

Europe Takes the Lead

It should come as no shock that Europe stands as the largest domain for online gambling. In the global context of 2015, the European Union market accounted for an impressive 47.6% of the €34.6 billion in online gaming gross win (total stakes minus winnings) generated. Although the triumph of online gambling in Europe is widely recognized, what truly sets the continent apart as a gambling front-runner is its proclivity for innovation, particularly evident in the expansion of thriving casino platforms.

However, given the somewhat delicate state of EU politics post-Brexit, queries are surfacing about the potential impact of economic protectionism on the future of gambling within Europe.

The Influence of Macau

Macau’s gambling culture has consistently held a significant presence, and the statistics underscores the ongoing expansion of gambling activities along the Chinese coast. The year-on-year monthly escalation in Macau’s casino revenue remains a stable 1.1%. This trajectory positions Macau on track to surpass annual revenue targets in the domain of gross gaming revenue.

Based on current figures encompassing infrastructure, visitation trends, and escalating spending patterns, projections suggest that Macau could attain heights of up to $53 billion by 2022. These insights emanate from a comprehensive Morgan Stanley report titled “Macau 2022 – Power of Compounding.” The report’s analyst asserts, “We anticipate that the growth quality will be superior, with over 80 percent of projected profits stemming from the mass market segment.

The introduction of the Hong Kong-Zhuhai-Macau Bridge in 2018 marked a pivotal shift in infrastructure, linking the regions of HK and Macau with China’s mainland city, Zhuhai. Concurrently, Hengqin island has been undergoing significant development endeavors, aspiring to transform the connected area into a global hub for leisure, tourism, and gaming. By 2022, we anticipate increased clarity concerning license renewals, developmental capital expenditures, and infrastructure expansion.”

Empowered by resilient and consistent growth statistics, Macau could potentially stand as the sole global destination – apart from Las Vegas – where land-based casino engagement thrives.

Australia’s Ascending Presence

When dissecting the global gambling landscape on a nation-by-nation basis, the gambling habits of the US, UK, China, and Japan have garnered extensive coverage. However, Australia’s role in the industry’s expansion might not be as immediately apparent. Statistics unveil that the average gambling loss per individual in Australia surpasses that of other nations, nearing the mark of $1,000. Singapore follows suit, ranking second in this regard, with the average loss per adult hovering around $650.

With Australian players demonstrating a willingness to invest above-average disposable income, Australia is undeniably poised to play a pivotal role in shaping the future of online casino gaming.

The Surge of Female Gamblers

Beyond the lens of national progress, there is another crucial factor to address: the escalating number of female participants in gambling. Women are now playing a more active role in profit margins than ever before. Statistics issued by the UK Gambling Commission (UKGC) reveals that women account for roughly 40% of all gambling engagement in the UK.

While games like bingo have traditionally resonated with women, a noteworthy shift is occurring as more individuals, specifically women, transition to other games, particularly slots, with each passing year.